White County has launched a new website designed to educate voters about the proposed Floating Local Option Sales Tax (FLOST), which will appear on the November 2025 ballot.

FLOST is a one-percent countywide sales tax designed to reduce property taxes. Because it is a sales tax, officials note, both residents and visitors would contribute to lowering the overall tax burden.

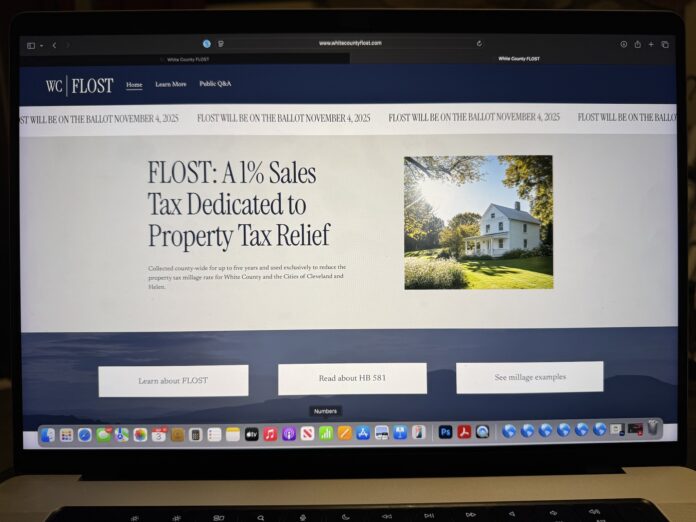

A news release from the White County Board of Commissioners says whitecountyflost.com serves as a centralized resource for residents to learn how FLOST works, its purpose, and its potential impact on property owners. The site also includes frequently asked questions and other background materials.

“Transparency and educating the public on the upcoming vote are top priorities for the White County Board of Commissioners,” says county spokesperson Bryce Barrett. “The website is intended to provide residents with clear, accessible information to help them make informed decisions about the future of the county.”

State law prohibits local governments from using public funds to advocate for or against revenue-generating referendums. However, officials are allowed to distribute factual materials about such initiatives.

If FLOST is approved, it will raise White County’s sales tax from 7 to 8%.